Driving Strategic Growth: Takeaways from Financial Brand Forum

Driving Strategic Growth: Takeaways from Financial Brand Forum

Adam Picker | Director, Commercial Markets

November 30, 2022

Innovation, ideas, and inspiration flowed throughout demos, sessions, and keynotes at the 2022 Financial Brand Forum.

Customer acquisition and data management and activation were primary drivers for many financial institutions attending the conference. Knowing attendees couldn’t be in every session, here are a few key takeaways related to these hot topics.

Customer Acquisition

While not an exhaustive list of acquisition tactics, four stood out in terms of opportunity and applicability:

1. Content strategy and SEO

It’s difficult to rise to the top in SEO for terms such as “best checking account” or “credit card for teenagers,” etc.

But a small change in mindset is setting some institutions up for sustainable growth. Shifting the thought process away from “sell a product” and toward “help a potential customer” proved key to a successful strategy.

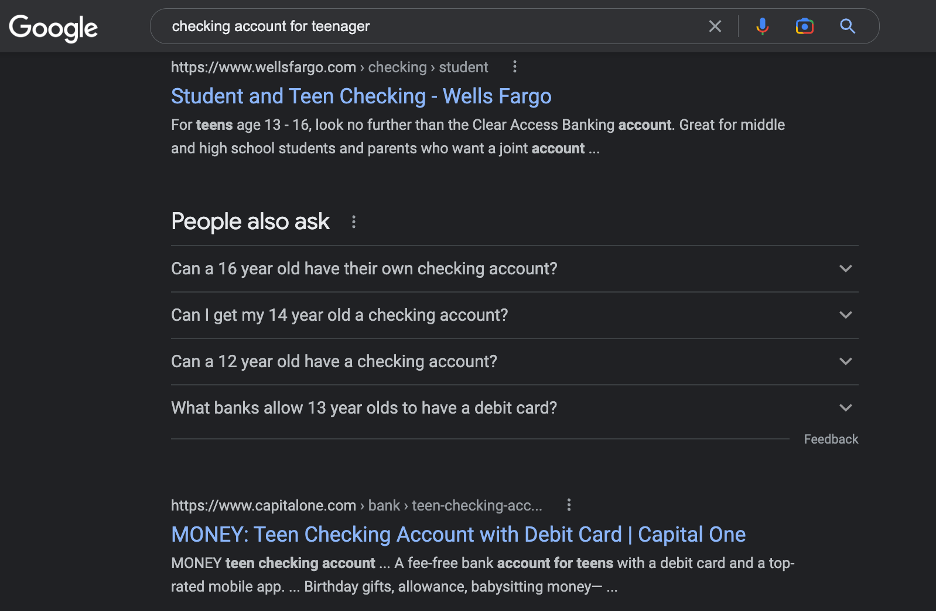

For example, here is a Google search where Capital One and Wells Fargo dominate the SERP (search engine results page) for “checking account for teenager”:

Most consumers who search this query are in an initial exploration mindset. It isn’t until they are closer to opening an account that their search queries get more detailed; they begin to tell Google what they really need.

For example, if a potential consumer were to search for “what teenagers need to know about checking accounts,” or “how to monitor my teenager’s checking account,” fewer financial providers have answers to these questions. Perceptive institutions are beginning to publish content helping parents answer these more granular questions, and it’s landing them new accounts with younger people who have many financial milestones ahead.

This depth of thinking across financial products is being used to create a content strategy that attracts high-intent, closer-to-conversion customers. (And, if you need help with your content strategy, that’s what we are here for!)

2. Intelligent, measurable geofencing

Geofencing technology uses a person’s location to trigger an event—usually a mobile notification—when their device crosses a specified geographic boundary. A few examples of how financial institutions are using geofencing for acquisition include:

- Partnering with car dealerships and realty offices in the vicinity of their locations. When customers visit one of those establishments, they are sent a push notification related to auto financing or insurance for car dealership customers, and home mortgage loan rates for real estate office customers

- Creating a “coffee for all” day. When customers come within a mile of a branch, they are invited in for a cup. A note/lesson learned was that the size of your geofence should be related to the region and population density. For example, a mile is much too big in NYC but could be just right in a suburb.

- On the recruiting side, geofencing is being used to send job opening/hiring messages to someone’s social media feed

- Verifying customers’ locations against card transactions for security (U.S. Bank)

3. Help communities fulfill their dreams

Duncan Wardle’s masterclass on innovation left attendees ready to take on the world. Duncan reminded me—and his audience of over a thousand—that divergent thinking is a critical element for growth.

His message to banks was, bluntly, to stop thinking of themselves as banks; it’s a self-fulfilling prophecy. By incorporating diversity into their thinking, and using empathy as a driving force, financial institutions can broaden how they frame the value of their products and services.

Duncan imparted ideas about the power of words. One example he used was whether the audience would rather visit a “car wash” or an “auto spa.” But it was more than just the name—what starts with a name flows down to new ideas that help fulfill the name. A car wash has water, soap, brushes, dryers, towels, etc. But an auto spa … maybe a barista, massage chairs, masseuse, or calming music. Which would you rather go to?

Duncan believes financial institutions should think less about selling products, and more about helping people along the path to achieving their financial potential.

Duncan’s thinking can be paired with Gina Bleedorn’s reminder of the “blue ocean strategy.” Gina, the Chief Experience Officer for Adrenaline, shared several inspiring examples of brand and storytelling. The blue ocean strategy states that as a bank, your goal doesn’t have to be to outperform other banks, but rather to redraw industry boundaries and operate within that new space, making the competition immaterial. As your institution floats in the ‘blue ocean’ of differentiation, there’s blood in the water (‘red ocean’) where other banks battle each other’s sameness. That differentiation is akin to Duncan’s idea of a total mindset shift.

4. Social media

While most financial institutions already leverage social media, I found at least one creative new spin on how to use it. Susan Guess of Paducah Bank created a next-level social media room in her institution’s headquarters, soliciting the help of ~70 volunteer community teenagers to make the concept a reality. As a result, Paducah Bank increased its social media presence while simultaneously creating new brand ambassadors.

Data Management & Activation

Several sessions delivered strategies for using data to acquire customers, offer relevant products, or improve the online banking experience. Regardless of what you’re looking to do with data, one message was clear: your data may never be in order; just do something with something.

Collecting the right data

SAP’s presentation touched on the kinds of data that might be meaningful to financial institutions as they look to grow, create new products, or determine relevant cross-sell offers. There are two key sets of data: operational data, and experience data.

Operational data is information such as product sales, financials, attrition, profitability, assets under management (AUM) per employee, and sales per branch.

Experience data covers CSAT, purchase intent, engagement, product feedback, and brand perception.

Small data sets, big impact

Rather than trying to boil the ocean with a data strategy, Synovus Bank pinpointed a few small use cases to get started. One case included tracking commercial deposits leaving the bank and using analytics to identify behaviors that indicate customer attrition risks. Once they internally identified an “at risk” client, they were able to alert the client’s banking relationship officer and suggest they connect with the client as soon as possible.

Getting to this level likely requires a mindset shift. Synovus’ goal was commercial retention, and only a few data points and patterns were needed to determine if a customer was a potential flight risk.

This approach also helps manage privacy and consent. When you tie a business goal to data collection, it softens the impulse to collect data indiscriminately.

Using data for personalization

Several presenters leaned toward empathetic thinking in order to implement impactful personalization. Jim Marous of the Financial Brand stated that personalization should be more than a tactic for your bank’s gain, but should look to deliver a memorable moment. This thinking allows financial institutions to hone their focus.

Ideas for empathetic personalization

- Send customers a tip or reminder on how to save money when the seasons change: Segment messages by ZIP code and add other parameters such as age/generation. Use a different tone in your messaging for Gen Z than Gen X. Also, instead of asking for something (selling), try to just be helpful.

- Financial literacy: One bank created a set of “financial quick tips” and gave customers the ability to opt-in for free financial advice notifications (in-app or emails). They didn’t ask for anything or try to sell anything. They created different tips for clients who were at different financial milestones. Parameters like account activity, balances, age, etc. were used to make messages feel personalized.

- Low barrier to entry platform: Google offers “Optimize” (there is a free starter version), a lightweight tool to begin implementing data-driven personalization with your website. Create a personalization strategy before you start A/B testing.

Wrap-up Thoughts

In the words of Ervin Magic Johnson during his keynote, “no matter what happens, we gotta figure out how to win.” That was a common theme for banks in attendance as they searched for innovation, ideas, and inspiration.

As a bank marketer, there’s a heck of a lot out there that you need to do, solve, and constantly think about. At the Forum, I experienced a huge community of like-minded folks working on the same challenges, who are willing to help and brainstorm with one another.

As an agency, Phase2 has strong points of view on some of the biggest challenges facing the most influential financial institutions, whether it's data management, digital experiences, or brand differentiation. We’re here to connect with you. We’re problem solvers, and we’d love to help you.

We hope you enjoyed reading the Phase2 blog! Please subscribe below for regular updates and industry insights.